Cabo FTL Systems LC Initiates Stock Analysis/Coverage of Volt Carbon Technologies, Inc.

The combination of Volt Carbon’s fundamentals, and the multiple indicators within the DDAmanda stock scanner has led us to issue a Strong Buy rating for Volt Carbon Technologies.

PALM SPRINGS, Calif., Oct. 17, 2022 /EINPresswire.com/— Cabo FTL Systems Stock Analysis/Coverage: Volt Carbon Technologies Inc. “Volt Carbon” (TSX-V: VCT, OTCQB:TORVF)

Cabo FTL Systems LC, “Cabo” has initiated stock coverage and analysis of Volt Carbon based on several alerts provided by our DDAmanda Stock Software. Collectively, Volt Carbon stock triggered alerts in DDAmanda by our proprietary “Drag Ratio” and “Factor” algorithms. These indicators showed unusual buying activity and this gives investors the opportunity to take an early position before a potential increase in share price.

What Volt Carbon is Doing:

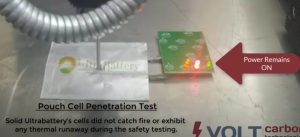

Volt Carbon acquired Solid UltraBattery, Inc. in 2021, headed by Zhongwei (Wei) Chen, PhD, who is recognized as a world leader in solid-state battery and fuel cell technology. Their 8-layer lithium-ion pouch cells using NMC811 chemistry is currently one of the most advanced formulations of Nickel Manganese Cobalt (NMC) cathodes available on the market for development of lithium-ion batteries, and is being considered as an alternative in the scale up of several electrical vehicle platforms.

In the June 2022 issue of “The Innovation Platform”, Volt Carbon states:

“The solid electrolyte is based on a metal-organic framework (MOF) and has shown outstanding capabilities. Preliminary testing of early prototype samples has shown that the technology can challenge more established competitors such as QuantumScape Inc. (NYSE: $QS), whose technology consists of a ceramic separator used in a lithium metal battery.”

In Sept. 2002, Volt Carbon filed a patent application for their Air Classification method which is a proprietary graphite separation technology consisting of an air classifier separating ore into high-purity graphite. This aerodynamic method of processing graphite uses no toxic chemicals, can be done at mining sites, and achieves purity levels of +90%.

Volt’s proprietary air classification processing method could significantly change the graphite mining industry by eliminating costs associated with transporting millions of tons of ore to processing facilities. It also eliminates toxic chemicals used for extraction, lowers facility power requirements, and minimizes any environmental impact. In total, this equates to a disruptor in graphite purification and processing systems.

Volt Carbon Share Price:

Volt Carbon’s $0.07 price per share is extremely low for a solid-state battery company that has patented technology and is manufacturing batteries in their own facilities. This share price in a field of other solid-state battery companies trading for dollars presents an opportunity for early entry before an increase in price occurs. This is indicative of DDAmanda’s ability to discover high potential stocks early on.

Daily trade volumes for Volt Carbon have been higher on Canadian exchanges, while trading in the U.S. is beginning to rise. As awareness for Volt Carbon picks up, so will the daily averages across all nine exchanges it’s traded on.

Shares Outstanding: 153,377,532

Float: 108,516,450

Warrants: 18,152,500

Options: 9,980,000

P/B Ratio: 4.5

Toxic Debt: $0.00

The combination of Volt Carbon’s fundamentals, and the multiple indicators within the DDAmanda stock scanner has led us to issue a Strong Buy rating, and set a $2.57 USD Price Target for Volt Carbon.

About:

Cabo FTL Systems LC was founded in 2002 and specializes in equity trading software and market analysis. Cabo’s DDAmanda stock software uses proprietary scanning algorithms. DDAmanda is one of the seven stock alert and scanning applications offered by Cabo FTL Systems LC.

Forward-Looking Statements:

This Press Release may contain a number of forward-looking statements. Words and variations of words such as: “expect”, “goals”, “could”, “plans”, “believe”, “may”, “will” and similar expressions are intended to identify our forward-looking statements, including but not limited to: our expectation for growth and benefits from brand-building.

These forward-looking statements are subject to a number of risks and uncertainties which could cause our actual results to differ materially from those indicated.

Disclaimer:

Cabo FTL Systems LC has a beneficial position in the shares of TSX-V: VCT, OTCQB:TORVF either through stock ownership, options, or other derivatives.

Cabo FTL Systems LC has not and is not compensated for any stocks mentioned.

FOR MORE INFORMATION

pr@caboftl.com

SOURCE: Cabo FTL Systems LC

Related Links

© 2022 Cabo FTL Systems LC. All product names and trademarks are the property of their respective owner or company. All rights reserved worldwide.